- You are here:

- Home »

- Top Story »

- Trump proposes to end U.S. student loan forgiveness program

Trump proposes to end U.S. student loan forgiveness program

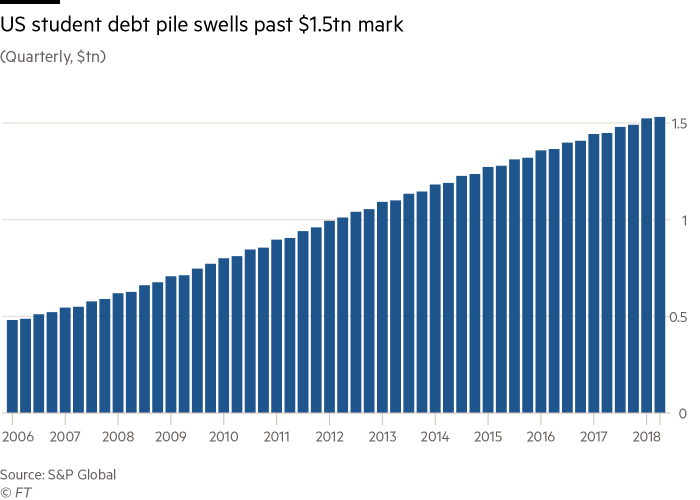

12 March 2019 (Washington, DC) – As we wrote at the end of 2018, U.S student loan burden had swelled past $1.5tn despite actual lending volumes falling for more than half a decade, as struggling students fall behind on their payment plans and debt relief programmes fail to offer sufficient succour. The overall size of US student debt has grown by $500bn since the 2010-11 academic year, according to a report issued by S&P Global, at the end-of the-year, but the credit rating agency had noted that loan origination has declined every year since then. That has been caused by payment adjustment schemes that offer some short-term relief but add to the overall long-term burden by reducing the minimum payment without lowering the interest rate, according to the report:

By reducing the payments, they allow borrowers to stay current, but the balance keeps growing. That’s what we’re seeing now. If the government is serious and concerned about growing student debt, then we need to come up with a broader plan rather than one that just helps a select few.

Student debt has emerged in recent years as a big concern for American households, politicians and policymakers, who fret that the rising burden is a long-term drag on the US economy by stymieing the ability of people to buy a home or start a business. A significant portion of the millennial generation has gone bankrupt before it could start building wealth, which is a — still-unaddressed — threat to the long-term health of the US economy. The U.S. student loan delinquency rate — how many loan balances are overdue by 30 days or more that were not delinquent in the previous quarter — fell to a 12-year low of 8.8 per cent in the second quarter of 2018, according to the most recent information issued by the New York Federal Reserve data:

There were various programs under way to offer some debt relief, such as the “Revised Pay As You Earn” scheme.

But any debt relief may now come to an end

Not-My-President Trump plans some major changes to your student loans, according to his 2020 budget, as we compiled from several sources. Here’s what you need to know and how it can affect you.

Trump Budget: Student Loans

The White House released Trump’s 2020 budget proposal, which contains important implications for higher education and student loans. The budget includes $64.0 billion in funding for the U.S. Department of Education, a $7.1 billion, or 10%, decrease compared to the 2019 funding. The budget, as it relates to student loans, is built on several stated goals, among others:

-strike a balance between students’ needs and taxpayer interests

-ensure fiscal discipline in discretionary spending

-reduce the role for the federal government in education

-reduce student loan debt

-increase accountability for institutions of higher education

-make higher education more affordable

-invest in technical and career education

Here are some specific proposals, among others, which could affect your ability to pay off student loans faster:

1. End Public Service Loan Forgiveness

Under Trump’s proposed budget, the Public Service Loan Forgiveness program would be eliminated.

The Public Service Loan Forgiveness program is a federal program created by President George W. Bush that forgives federal student loans for borrowers who are employed full-time (more than 30 hours per week) in an eligible federal, state or local public service job or 501(c)(3) nonprofit job who make 120 eligible on-time payments over ten years.

The proposal would impact borrowers who borrow a new student loan starting July 1, 2020, excluding borrowers who are completing their current course study. Therefore, if you borrow or have borrowed a student loan prior to that date, you would presumably still be eligible for this student loan forgiveness program.

Potential Rationale: Save the federal government money.

Potential Impact: While the federal government would save money, ending the Public Service Loan Forgiveness program could deter student loan borrowers from entering public service jobs, and could adversely impact public servants, including members of the U.S. Armed Forces, police officers, firefighters, first responders, prosecutors, public defenders and others.

2. Change Federal Student Loan Repayment

According to the Trump administration, there are too many income-driven repayment plans for federal student loans, which causes confusion for student loan borrowers. Income-driven repayment plans such as PAYE and REPAYE enable borrowers to repay their federal student loans based on income, family size and other factors, and can result in student loan forgiveness.

Trump’s repayment plan would reduce the number of income-driven repayment plans to one, and offer student loan forgiveness for both undergraduate and graduate federal student loans.

Undergraduate student loans: Monthly student loan payments would be capped at 12.5% of income. After 15 years of monthly payments, any remaining student loan debt would be forgiven. This is five years earlier than current income-driven repayment options for undergraduate student loans.

Graduate student loans: Monthly student loans payments would be capped at 12.5% of income. After 30 years of monthly payments, any remaining student loan debt would be forgiven. This is five years later than current income-driven repayment options for graduate student loans.

Potential Rationale: Reduce confusion for borrowers and simplify choices.

Potential Impact: The proposal could save borrowers time and limit confusion. Undergraduate student loan borrowers can receive student loan forgiveness sooner, while graduate student loan borrowers would wait longer for student loan forgiveness. This proposal particularly helps undergraduate borrowers, who typically earn less than graduate school student loan borrowers.

3. End Subsidized Student Loans

The president’s budget also would eliminate subsidized student loans, which traditionally has meant that the federal government pays the interest costs on federal student loans while borrowers are enrolled in school.

Potential Rationale: Save the federal government money.

Potential Impact: The federal government would earn money by collecting additional interest. If subsidized loans are eliminated, the cost to attend college and graduate school for borrowers could become more expensive due to more interest costs.

Will this budget become law?

The budget will face legislative review …. and even many Republicans hate it … so who knows. As we all learned in school, while the president proposes a budget, only Congress passes appropriation bills. The White House has introduced many of these proposals in prior budgets, but they were not implemented. Now that the Democrats control the U.S. House of Representatives, the White House may face further roadblocks. Stay tuned.