- You are here:

- Home »

- Uncategorized »

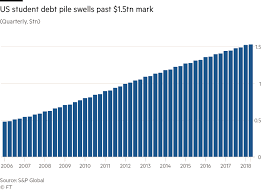

- U.S. student debt balloons past $1.5 trillion

U.S. student debt balloons past $1.5 trillion

The overall size of US student loan debt has grown by $500bn since the 2010-11 academic year

5 September 2018 – The US student loan burden has swelled past $1.5tn despite actual lending volumes falling for more than half a decade, as struggling students fall behind on their payment plans and debt relief programmes fail to offer sufficient succour. The overall size of US student debt has grown by $500bn since the 2010-11 academic year, according to a report by S&P Global, but the credit rating agency notes that loan origination has declined every year since then. That has been caused by payment adjustment schemes that offer some short-term relief but add to the overall long-term burden by reducing the minimum payment without lowering the interest rate, according to John Anglim of S&P:

By reducing the payments, they allow borrowers to stay current, but the balance keeps growing. That’s what we’re seeing now. If the government is serious and concerned about growing student debt, then we need to come up with a broader plan rather than one that just helps a select few.

Student debt has emerged in recent years as a big concern for American households, politicians and policymakers, who fret that the rising burden is a long-term drag on the US economy by stymieing the ability of people to buy a home or start a business. “A significant portion of the millennial generation has gone bankrupt before it could start building wealth, which is a — still-unaddressed — threat to the long-term health of the US economy,” Vincent Deluard, a strategist at INTL FCStone, said in a report. The US student loan delinquency rate — how many loan balances are overdue by 30 days or more that were not delinquent in the previous quarter — fell to a 12-year low of 8.8 per cent in the second quarter of 2018, according to New York Federal Reserve data.

![]()

![]()

The decline is largely thanks to the strong economy and robust jobs market. The unemployment rate for graduates with a bachelors degree or higher now stands at just 2.2 per cent in the US, compared with 5.1 per cent for those with less than a high-school degree and 4 per cent for high school graduates who spent no time in college. The size of the pool of bonds backed by student loans has also gradually declined, from $242.6bn a decade ago to $175.6bn at the end of the second quarter, according to data from the Securities Industry and Financial Markets Association.

Nonetheless, student debt remains the worst-performing area of consumer credit. Brookings, the think-tank, warned in a January report that according to the default trends of past age cohorts, as many as 40 per cent of borrowers could default on their student loans by 2023.

There are various programmes designed to offer some debt relief, such as the “Revised Pay As You Earn” scheme introduced at the end of 2015, but these are in practice not helping whittle down the overall student debt burden, S&P’s report argued. The rating agency said the failure of these income-determined repayment plans to whittle down the overall student debt pile was because of “misplaced” incentives that will in practice simply shift the burden over to the government. Said Anglim:

We underestimate how much this will cost the government over the next 20 years if it just has to eventually forgive them.